|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

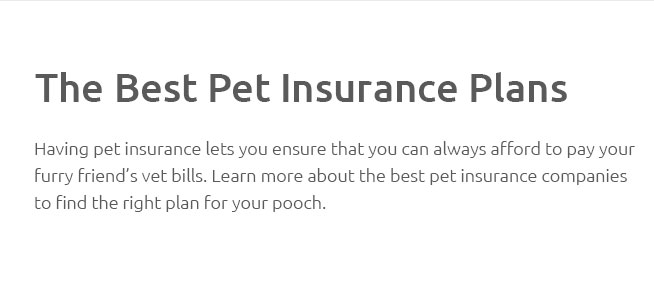

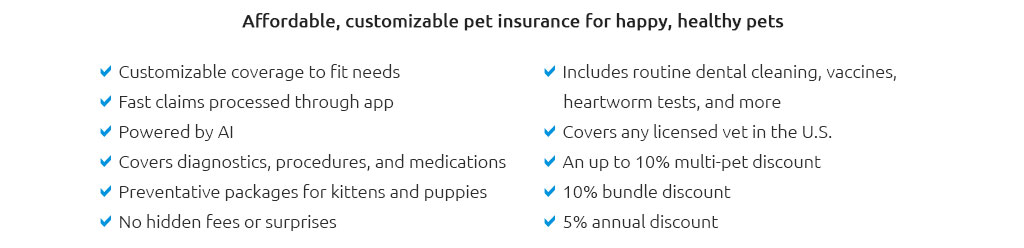

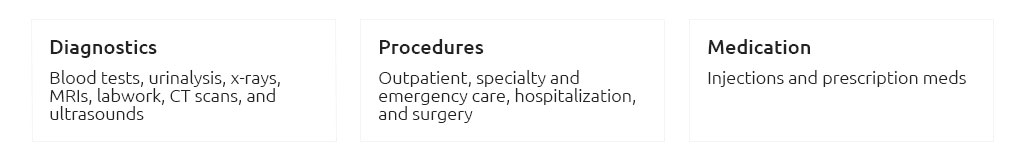

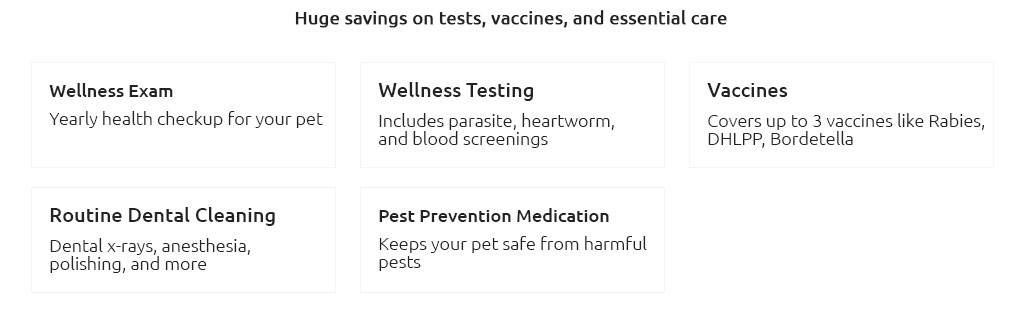

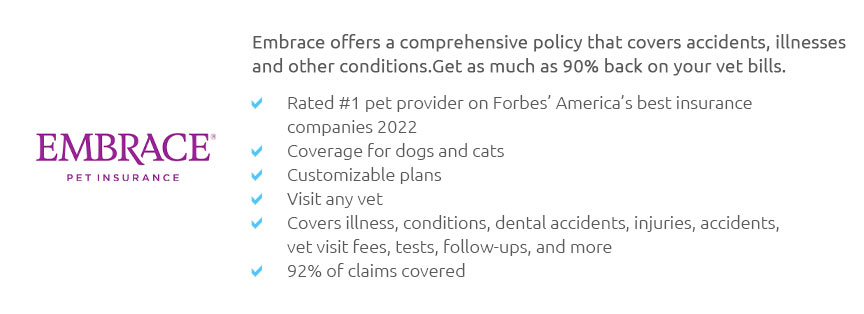

Exploring the Intricacies of Multi-Pet Insurance Deals: A Comprehensive GuideIn today's fast-paced world, the notion of owning multiple pets is no longer a rarity; rather, it has become a cherished lifestyle choice for many families. With this increase in pet ownership, the demand for multi-pet insurance deals has soared, prompting insurers to offer tailored packages that cater specifically to households with more than one animal companion. The allure of these deals lies not only in their cost-effectiveness but also in the convenience they bring to managing the health and well-being of our beloved pets. However, navigating the myriad of options available can be a daunting task, requiring a keen understanding of the nuances involved in selecting the right policy. At its core, multi-pet insurance is designed to provide coverage for two or more pets under a single policy, often at a discounted rate compared to insuring each pet individually. This approach offers several advantages, chief among them being the potential for significant savings on premiums. Furthermore, managing one policy instead of multiple can simplify administrative tasks and streamline the claims process, allowing pet owners to focus more on the joys of pet companionship rather than the intricacies of insurance paperwork. When considering multi-pet insurance, it is essential to evaluate a variety of factors to ensure that the chosen policy aligns with the specific needs of your furry family members. Coverage options vary widely between providers, with some offering basic accident-only coverage while others extend to comprehensive plans that include illness, routine care, and even alternative therapies. It is advisable to thoroughly scrutinize the policy details, paying close attention to exclusions, waiting periods, and the extent of coverage provided for pre-existing conditions, if any. Another critical aspect to consider is the insurer's reputation and customer service track record. A provider known for prompt and hassle-free claims processing can make a significant difference in moments of urgency. Reading reviews and seeking recommendations from fellow pet owners can provide valuable insights into the reliability and responsiveness of potential insurers. Additionally, some companies offer perks such as 24/7 helplines and access to telehealth services, which can be invaluable in providing peace of mind. It is also worth exploring the flexibility of the policy terms. Some insurers offer the option to customize coverage to fit the unique needs of each pet, which can be particularly beneficial in households with a diverse range of animals, from dogs and cats to more exotic species. This flexibility allows pet owners to tailor their insurance to suit the age, breed, and health status of each pet, ensuring comprehensive protection without unnecessary expenditure.

Frequently Asked QuestionsWhat is multi-pet insurance? Multi-pet insurance is a type of policy that covers two or more pets under one plan, often at a discounted rate, offering ease of management and potential savings on premiums. How do I choose the right multi-pet insurance? To choose the right multi-pet insurance, consider factors such as coverage options, exclusions, waiting periods, insurer reputation, and the flexibility of policy terms. Are there any downsides to multi-pet insurance? While multi-pet insurance offers many benefits, potential downsides include limited customization for each pet and the possibility of higher premiums if one pet develops a chronic condition. Can I add new pets to an existing multi-pet insurance policy? Yes, most insurers allow you to add new pets to an existing policy, though it's important to check if this will affect your premium or coverage levels. https://www.pawlicy.com/blog/multiple-pet-insurance/

Multi-pet coverage varies from one insurance company to the next, but some providers can offer you a discount as high as 10% for insuring multiple pets under ... https://www.bankrate.com/insurance/pet-insurance/pet-insurance-for-multiple-pets/

Multiple pet insurance companies offer a 510 percent discount on any additional pets you insure. Besides cost savings, pet insurance for ... https://www.moneygeek.com/insurance/pet/best-pet-insurance-more-than-one-pet/

Multi-Pet Discounts & Average Policy Costs for $10,000 Coverage - 1. GEICO. 10%. $76.94 - 2. ASPCA. 10%. $88.69 - 3. Embrace. 10%. $76.94 - 4. Pumpkin. 10%.

|